EMpowering customer centre officer

TIME

MAR 2016 - SEP 2016

my role

UX researcher and UX designer for redefined customer journey

Project statement

Enable the bank's customers to have transactions done via phone banking in a way Customer Centre officers are empowered to execute customer requests to fulfil instant transaction needs.

Challenges

From the review of inbound calls of Customer Centre, it is found that there were many customer requests for fee waivers, shorter transaction processing times and better discounts while Customer Centre officers were not delegated to execute the requests and had to put customers wait until they obtained agreement from product managers or operations managers.

Results

30% reduction on failure demand resulted from improved DOA process. CCO Attribution Scoring increased from 4.55 to 4.69 on a 5 point scale. First call resolution improved from 91.5% to 92.9%.

APProach

Data analysis & VOC on inbound calls

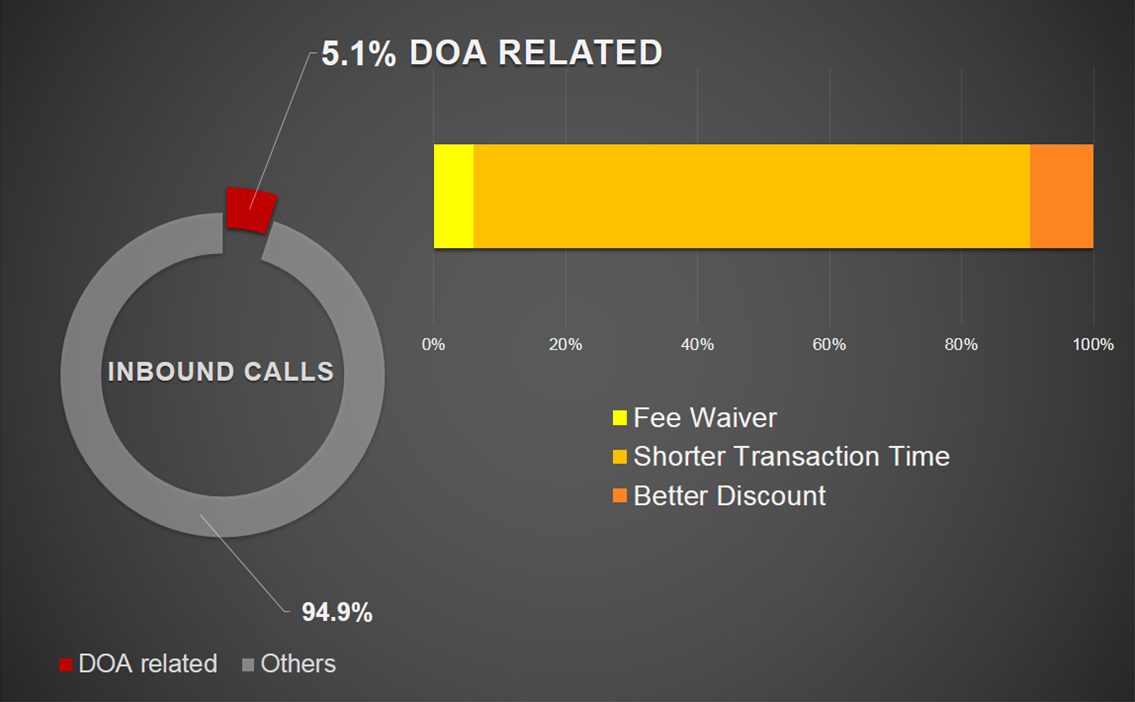

Project members and I reviewed 2015 whole year inbound calls and found 5.1% of the calls were about requesting the following:

- around 50 calls per month on fee waiver

- around 700 calls per month on shorter transaction processing time

- around 80 calls per month on better discount rate

Voice of customers were also gathered from recorded calls. We applied affinity clustering to sort out the most painful point for customers - they do not want to wait for Customer Centre officers to get approval from other people on their requests, they want their jobs-to-be-done getting done right away.

MAPPING OUT the customer journey

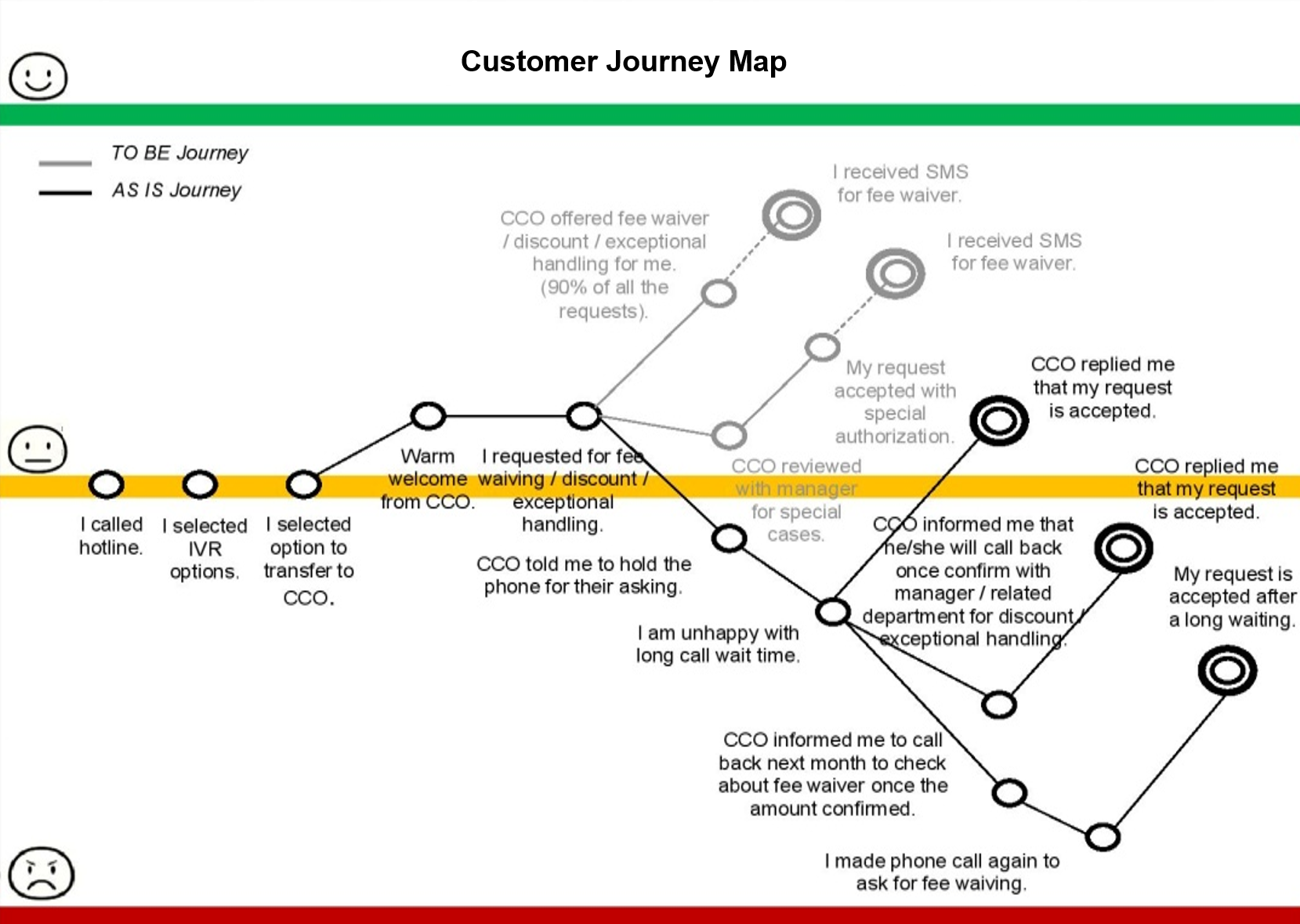

I mapped out as-is customer journey based on the understanding of current handling process and voice of customers. Based on the as-is journey, we were able to marked down opportunities for improvement, and proposed a to-be journey for customers having the above requests.

stakeholder mappING

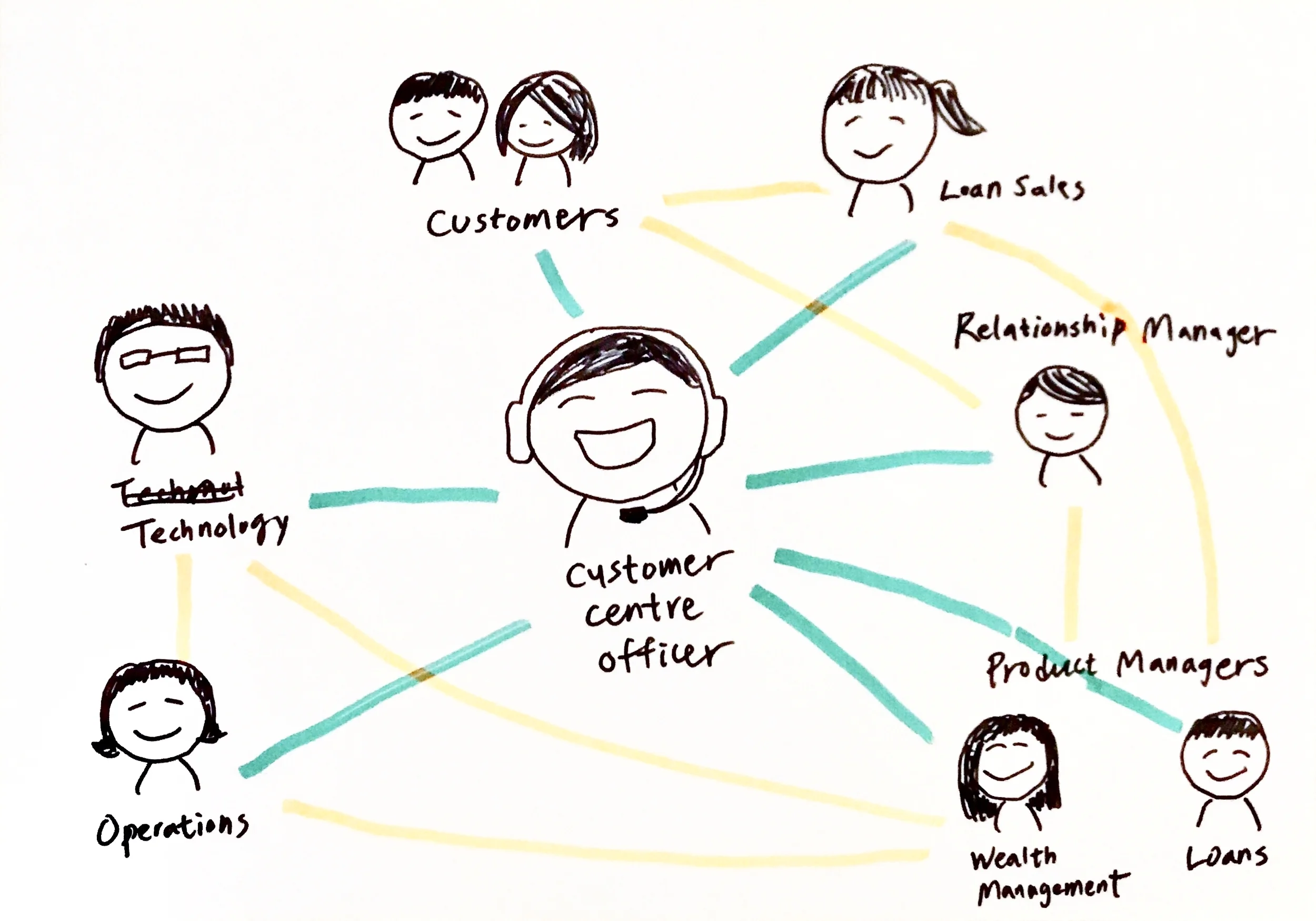

Stakeholders related to such requests were identified. The holistic view on the network surrounding Customer Centre officers facilitated the project team to further understand how each role would be affected by the design options. Interviewing and sharing with the stakeholders also allowed the team and relevant counterparts to form a shared understanding on how we could improve customer experience in this area.

obeya: Refining doa process

Different stakeholders were invited to jointly discuss on the proposed to-be customer journey. Refined DOA process was agreed upon every team's agreement including product managers and operation managers, to allow Customer Centre officers make timely decision for the above requests under a certain amount limits, and also allow officers to agree to shorten transaction processing time within a given range. Besides the DOA changes, as-is transaction processing time was also accelerated because of streamlined workflow.

critique & final implementation

The final version of new DOA process and streamlined relevant transaction workflow were presented to sponsors (i.e. head of each involved business and support units) for their feedback. Post critique session, the proposed changes were then effective after official communication within every unit.