Tapping into the gig economy

“In a gig economy, temporary, flexible jobs are commonplace and companies tend toward hiring independent contractors and freelancers instead of full-time employees.

Workers in gig economy do not receive pension benefits or other employee rights and benefits, their payment scheme is linked to the gigs they perform which could be deliveries, rentals or other services.”

time

JUL 2017

my role

UX Researcher

Project statement

Enable people working in the gig economy to enjoy benefits of new forms of financial services.

Challenges

As the rising gig economy attracts more and more people working as freelancers, financial needs may transform because of new ways of making earnings. To meet the transformed needs in ahead of other key competitors, we have to innovate our financial products and services.

Results

This is a special project that my team members and I were nominated to participate in a 5 day innovation workshop to solve the challenge statement in Singapore. Feasibility of implementation is under country GM and senior management's evaluation.

APProach

PERSONa

Social Influencer is concluded as the Persona we would like to focus on after brainstorming on all kinds of freelancers we could see in the society nowadays.

interviewing & AFFINITY CLUSTERING

Interviews were done with 2 emerging social influencers in Taiwan based on the Persona we have concluded previously. Details from interviews were being recorded down and enabled us to find clues from the 2 social influencers. Through sorting out the clues, we discovered that rising social influencers have the following common ground:

their income is unstable because of uncertain popularity

their cash conversion time is longer than they hoped it could be

they desire lucrative product endorsement

The above then lead to the financial needs we realised emerging social influencers may have.

Concepts ideation

To depict the scenarios for financial needs we derived from interviewing the two emerging social influencers, I used storyboard to showcase how and when such financial needs kick in.

Base on the defined scenarios, we brainstormed on what kinds of new forms of financial products or services can be developed to fulfill those needs. At the end, there're two kinds of services we think may be beneficial to our Persona.

Get Money Now! - This is Account Payable Financing for social influencers as usually the intervening period of receiving payments from platforms and channels they collaborate with is quite long, and they long for shortening their cash conversion time.

Turn Likes into Collateral - This is to apply data analytics to build a innovative credit model on accessing social influencers' past performance and predicting their future performance on attracting followers, likes, interactions and revenue, so that they could secure regular and stable funding to fulfill their future needs.

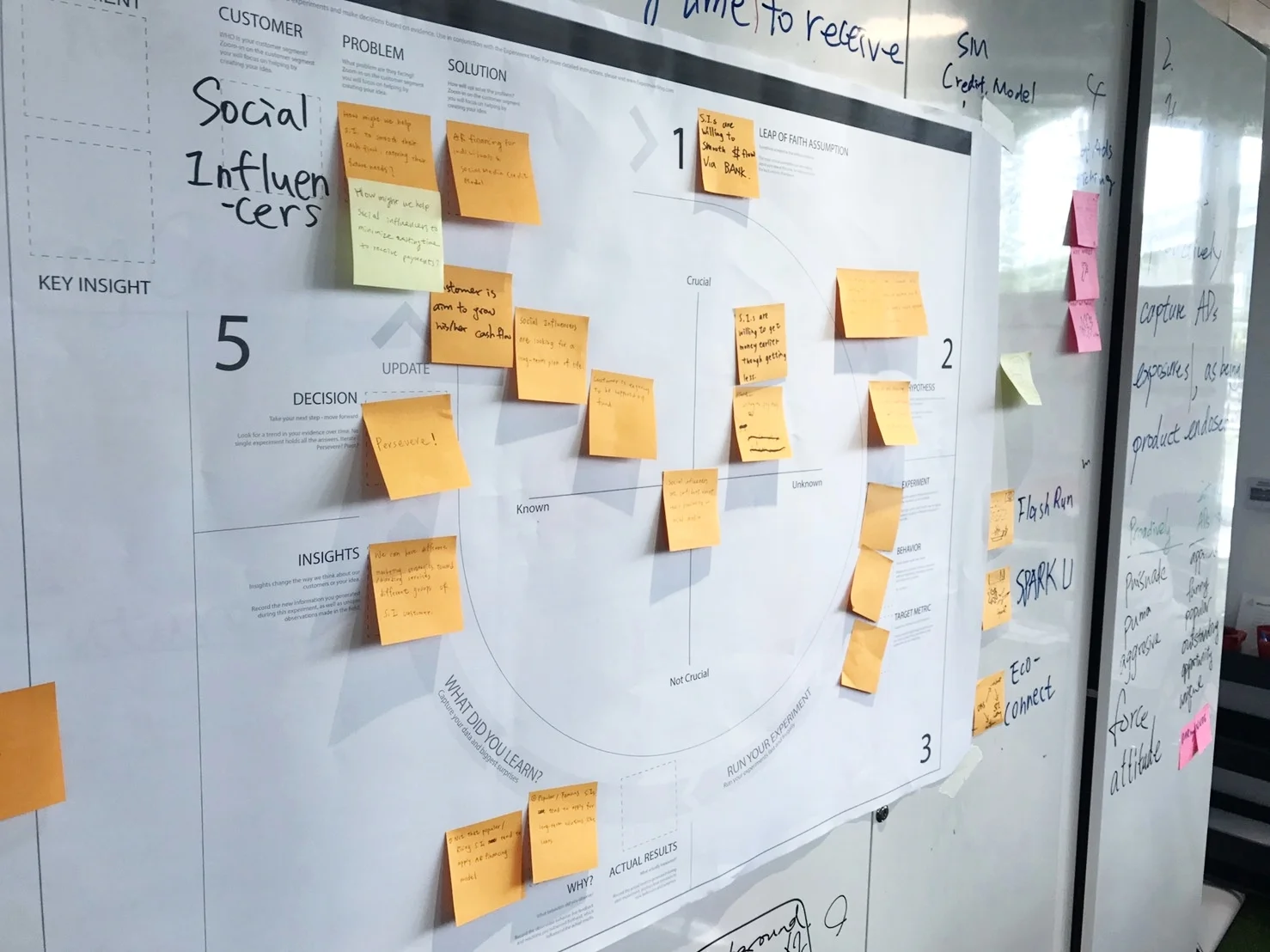

experimenting on new financial services

The assumption with the highest priority we would like to test is 'Social influencers are willing to smooth their cash flows via bank.'

We took the two major financial services we developed from the concept ideation back to the two social influencers we interviewed, also surveyed among few other emerging social influencers. More than 80% of the responses to the new services were positive.

final IMPLEMENTATION

The micro-site is to demonstrate our ideas for providing new forms of financial services to social influences. Feasibility of implementation is under country GM and senior management's evaluation.